MONEY CHECK-INS

FOR PREVIOUS CLIENTS ONLY

PREVIOUS Clients can now partner with Stephanie on an annual basis with Money Check-Ins!

MONEY CHECK-IN

$

MONEY CHECK-IN $

KINDA LIKE HAVING MONEY MUSE ON RETAINER…

Money Check-Ins are a chance to partner with me as your own personal financial sidekick!

Money Check-Ins are a great time to:

Review your previous $$$ plan including amounts allocated to spending, saving, investments, and goals. Do these amounts need to be updated based on life, job, or goal changes?

Investment account types, amounts, asset allocations, and portfolio returns. Do you want to invest more each month? Or perhaps a lump sum? Is your asset allocation still right for you based on your risk tolerance, time, and interest level?

Set a new goal, and create an action plan to get there. Want to buy a house, have a wedding, have a baby, take a sabbatical, or retire early? Let's make a plan for that!

TWO ANNUAL CHECK-INS

-

2 sessions per 12-month period (2x 1hr sessions) via Zoom

Unlimited support via email

Notes, actions, and homework provided between sessions

Spreadsheets of income, expenses, assets, debts, and net worth

-

$500 PER MONTH OR

$5000 PER YEAR (SAVE $1000)

WAYS TO USE YOUR MONEY CHECK-IN

👩💻 Got a new job or a raise?

Reassess how much you're investing each month

🏡 Moved, had a baby, got married/divorced, or other significant change in expenses?

Recalculate emergency savings and come up with a plan to get there

Reassess spending plan and investments to be sure you're still on track

💵 Want to make more money in 2024?

Come up with a plan to negotiate a raise or make a job change

Get help starting a business or side hustle

📈 Curious if your current investments are still right for you?

Go through a risk tolerance analysis

Calculate your portfolio performance

Make updates to align with your vision

🤑 Want help with reducing taxes?

Get help starting a business or side hustle

💰 Got a chunk of money you don't know what to do with?

Go through a prioritization exercise to figure out how to best allocate the money to savings, investments, or goals

🥳 Curious how your retirement plans are coming along?

Let's run the numbers and come up with a plan to get you to your next phase

RECENT CLIENT LOVE NOTES

”Not only have I achieved "some of my money goals in a short amount of time, I feel that Stephanie is helping me build a life-long foundation for more effective money management.”

— MARIA MCDONALD, CLIENT

“My only feedback is that working with you was amazing!! Seriously, it was so helpful and I feel more comfortable navigating $$ decisions than I ever thought I would.”

— SPRING 2023 CLIENT

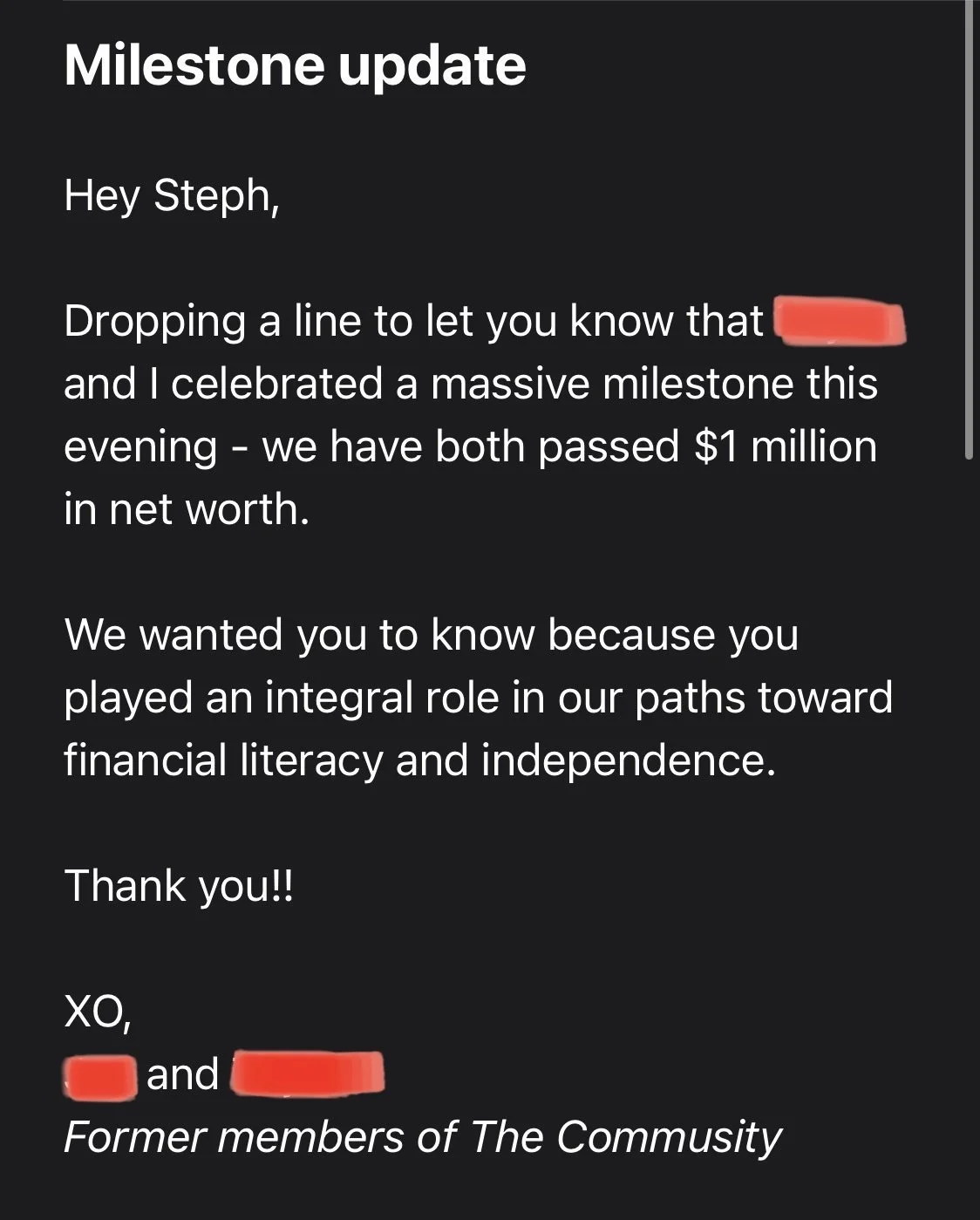

💸 EMAILS FROM TWO CLIENTS WHO RECENTLY JOINED THE MILLIONAIRES CLUB 💸

“I recently received a promotion and a $25,000 annual increase in pay! Holy cow!! THANK YOU for your advice and passion in advocating for pay equity. Your workshop and coaching has truly transformed my relationship with money.”

— HAPPY CLIENT IN SEATTLE, WA

FAQS

-

What is a money check in?

A money check in is a session with Stephanie to update or tackle any new topic that's come up in your financial life or to review progress and make changes to your financial plan.

-

How does it work?

Check-ins are purchased in advance, and can be used anytime, depending on your preference. Think of it as partnering with Money Muse on retainer, for any of your money questions that come up during the year.

-

How long are they good for?

Check-ins are designed to be used within a 1 year period from purchase. If you'd like to to partner quarterly on achieving your financial goals, we recommend the purchasing 4 sessions.

-

What is a quarterly check in good for?New List Item

A quarterly check-in is ideal for reviewing in more detail your financial plan and progress. It is also good for checking in on new financial opportunities that present themselves such as a raise, job change, or buying a house.

-

What is an annual check in good for?

An annual check in is great to review your financial plan and investments, and determine if anything needs to be changed based on your goals, returns, or life changes.

-

How do I sign up?

You can purchase up to 4 check-ins per year, in any increment!